The Artsy Asks Series

Experts answer the most important questions for galleries today.

Who

Alexander Forbes joined Artsy in 2015. He leads Artsy’s partnerships with galleries, auction houses, benefit auctions, and art fairs. He previously led Artsy’s private sales and corporate development divisions after serving as the Executive Editor of Artsy Editorial.

Portrait of Alexander Forbes by Douglas Escalante.

What are collectors looking for now? As the art market continues to evolve, so do the preferences and behaviors of collectors. Many of today’s buyers are embracing online channels, often discovering and purchasing art through digital platforms. Artsy provides galleries with essential tools to keep up with these shifts—from tailored alerts that match collectors’ interests to streamlined e-commerce options that make closing sales easier than ever.

We sat down with Alexander Forbes, Artsy’s Vice President of Global Partnerships, to discuss what Artsy’s data tells us about collector behavior and how galleries can use Artsy to stay on the pulse of art buying trends.

What is the #1 trend in collector behavior that you’ve observed this year?

The past two years have been challenging for galleries. This year, however, contrary to what we hear about our galleries’ in-person sales at their physical locations and art fairs, we’ve seen success online: The average sales per gallery on Artsy increased in 2024 compared to 2023. In October, per-gallery sales reached the highest level since 2021—up 15% year-over-year across all market segments, and with some galleries seeing nearly 40% year-over-year sales growth.

“The average sales per gallery on Artsy increased in 2024 compared to 2023. In October, per-gallery sales reached the highest level since 2021—up 15% year-over-year across all market segments, and with some galleries seeing nearly 40% year-over-year sales growth,”

Alexander Forbes, Artsy’s Vice President of Global Partnerships

A generational and demographic shift among collectors contributes to this contrasting picture. The traditional stalwart collectors, whom many galleries have optimized their marketing and sales presence around, are aging out of their peak spending years, and new collectors prefer buying online. According to Clare McAndrew’s recent art market report for Art Basel and UBS, 90% of the fair’s VIPs preferred viewing and purchasing works in person, whereas 80% of the high-net-worth individuals surveyed—representing a much larger sample of the population—prefer to buy art online without viewing the work in person first.

The report’s findings indicate that galleries that don’t have a robust online presence need to act fast, while those that do should consider increasing their investment in online channels, including Artsy and the employees that manage them. There is just too much opportunity in that broader population of collectors to ignore.

Getting started or scaling up online can feel daunting to some galleries. And getting the right strategy in place is incredibly important for success. It’s something our gallery liaisons work with galleries on every day—and it’s been incredible to watch certain galleries take our team’s advice and increase their online sales tenfold in the course of just a year or two.

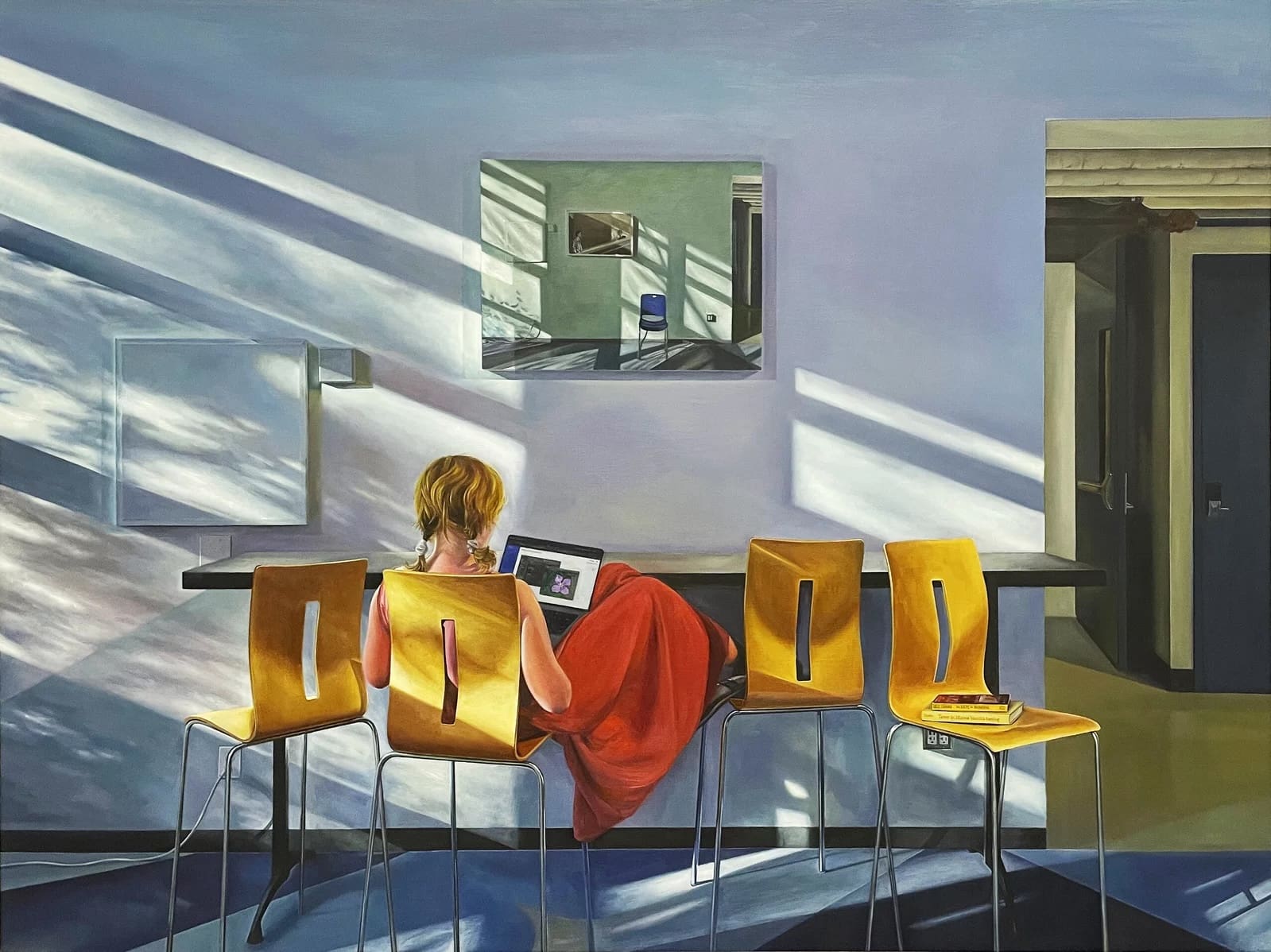

Yu Cheng, Behind Peace II, 2024, Alpha Gallery.

What trends do you see among Artsy collectors right now? Are there specific purchase behaviors that have gained popularity recently?

We continue to see e-commerce sales grow at a faster rate than sales via inquiry where collectors have to eventually receive an invoice and wire funds externally. For example, e-commerce sales of limited-edition works on Artsy are up 60% year-over-year, and the average value of works sold via e-commerce is up by more than a third.

“E-commerce sales of limited-edition works on Artsy are up 60% year-over-year, and the average value of works sold via e-commerce is up by more than a third.”

Alexander Forbes, Artsy’s Vice President of Global Partnerships

Galleries say collectors have been taking longer to make purchases both offline and online in recent years, and have dropped off at later stages of a potential transaction than was typically the case previously. Particularly for works priced under $10,000, selling via e-commerce significantly reduces moments for collectors to second-guess their purchase. In contrast, engaging in a lengthy inquiry, email, or WhatsApp conversation, and then sending an invoice, gives the buyer many opportunities to disengage. Art is a passion-led purchase, and it’s particularly important to capture buyers as close to that initial moment of passion as possible when the market is undergoing a period of recalibration.

It’s been exciting to see galleries that typically can’t list unique or higher value works via e-commerce or with their prices public due to artists’ concerns, begin to list more works via e-commerce.

How does Artsy’s platform support gallerists in building long-term relationships with collectors?

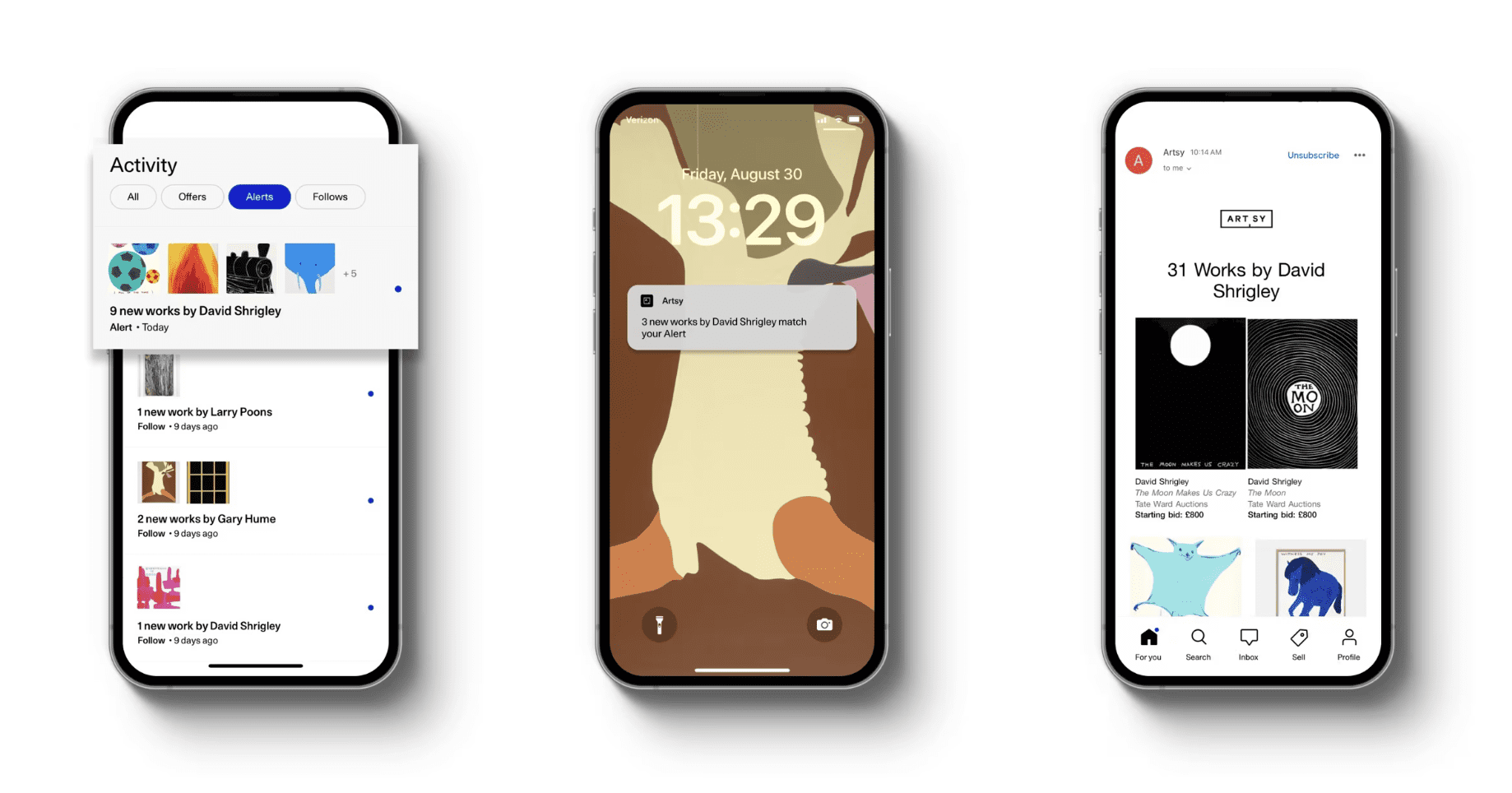

Many of Artsy’s products and recommendation algorithms are built to foster repeat engagement between our collectors and galleries. As collectors follow artists and galleries, they automatically see new works that the galleries publish on Artsy. Building up a strong following for their artists and gallery is a hugely important tactic that top-performing galleries on Artsy leverage as part of their overall marketing strategy. They know that collectors’ attention spans are stretched thin and make sure that a collector who might have missed the gallery’s own email blast still sees the work with Artsy’s personalized notifications. Additionally, our Conversations feature allows galleries to filter past inquiries on a particular artist or from a particular collector so they can send them new works ahead of upcoming shows and art fairs.

Even galleries with massive online sales teams, extremely sophisticated marketing practices of their own, and who assign individual sales directors to manage collectors they meet on Artsy, tell us regularly that the collectors they meet on Artsy are more likely to get back in touch with them via our platform. We even hear that galleries’ top existing clients whom they have never interacted with on Artsy before end up inquiring on works they are recommended in our app.

What kind of data insights does Artsy provide about collectors to help gallerists understand current market trends or forecast future ones?

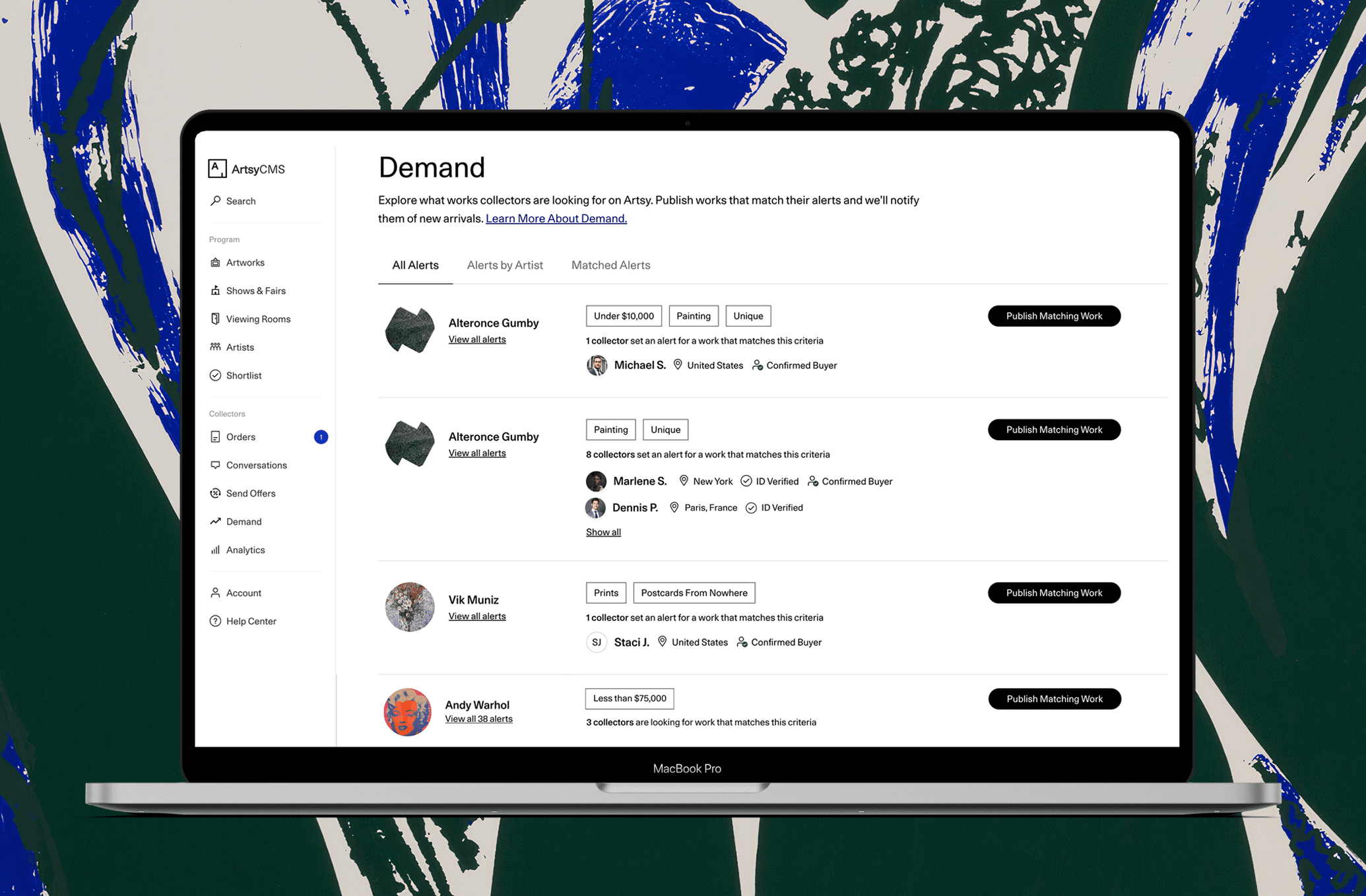

We’ve really ramped up our investment here in the last two years. We’ve given collectors the ability to share much more detailed information about themselves, their collection, and what they’re looking for—like a collecting business card—which we then provide to galleries when the collector inquires about a work.

We also show galleries the saved searches that collectors have set for their artists, allowing them to target what they upload to Artsy down to specific artists, mediums, price ranges, and other criteria. Lastly, galleries can also see when collectors have saved or started to place an order on one of their artworks; we then allow the gallery to send a personalized offer to the collector to help pull them over the line.

How are online sales changing the way collectors interact with art? Are collectors mostly buying online, in person, or both?

Online and offline are extremely complementary. Most people buy art to live with it, which suggests they enjoy being with art in person. Many people like seeing works they might buy in person before pulling the trigger (whether offline or online). These days, very few collectors exist only offline or online. For example, about 80% of collectors across demographic groups that we surveyed recently have purchased art online and 67% of them attend between two and five art fairs each year. We have some galleries that have forgone their physical spaces entirely, but the vast majority still have a brick-and-mortar gallery.

Similarly, we have some clients who are celebrities or public figures and appreciate not having to participate in the see-and-be-seen hubbub of art fairs and gallery openings in order to purchase and live with art. But most have adopted a hybrid approach. Where our platform truly differentiates itself from the offline world, however, is connecting galleries every day with collectors half a world away who fall in love with their artists and program. It would be financially impossible for even the world’s largest galleries to attend art fairs in every corner of the world to get that reach. We give it to them for less than the cost of a single fair.

“Where our platform truly differentiates itself from the offline world, however, is connecting galleries every day with collectors half a world away who fall in love with their artists and program. It would be financially impossible for even the world’s largest galleries to attend art fairs in every corner of the world to get that reach.”

Alexander Forbes, Artsy’s Vice President of Global Partnerships

What advice would you give to gallerists about presenting their inventory on Artsy to attract today’s collectors?

Provide as much information as possible. Collectors want to see multiple images of a work, including detail and verso shots. They want to understand how a particular work fits into the artist’s practice. They want detailed provenance and condition information for secondary-market works.

Moreover, collectors want to see a wide selection of works by the artist to find the one that most resonates with them. I’ll often hear from galleries that they’ve uploaded one or two works by a given artist and that collectors should reach out to them if they want to see more. While this may work in an art fair context, it’s simply not how people browse for and buy things online. Art is special, but humans tend to follow the patterns of the context in which they’re browsing: They expect to know the different metals and face colors a watch they’re looking at comes in, the vintages of a certain wine that are still available, and at minimum a representative selection of the works currently available by a given artist they find before inquiring or making a purchase.

The more works and more information about each work that a gallery publishes, the better their presence will be optimized for search engine traffic, which continues to be one of the biggest drivers of commercial activity on Artsy. Luckily, our galleries don’t have to navigate this landscape alone—each gets a gallery liaison who is expert in the strategies that are most effective for each type of gallery and their particular goals.